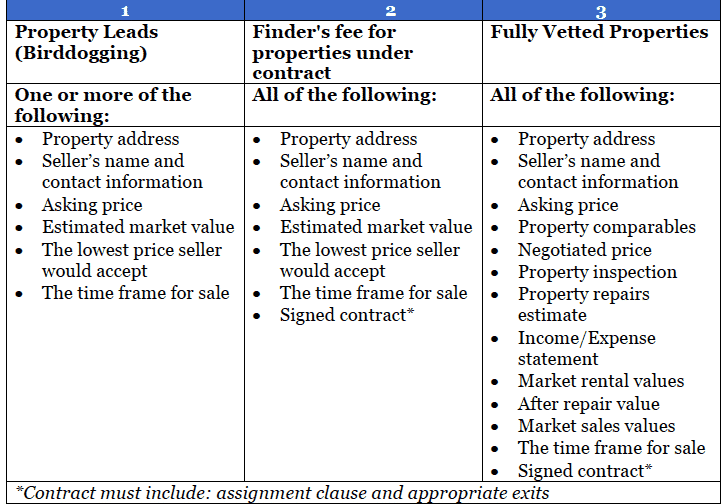

In your Wholesale business, there are multiple ways to created profitable transactions. The more information you provide for your investor, the more money you can charge per transaction. There are three approaches commonly used to achieve profitable transactions.

- Selling property leads (also known as bird-dogging): Offers investors a potential property opportunity based on their defined perimeters and property types. This does not require you to have the property under contract to sell the lead. The Wholesaler may earn as much as $500 or more for each deal finalized by the investor.

- Finder’s fee for properties under contact: Unlike selling property leads, this approach does require a signed contract. The signed contract allows you to assign control of the property to the investor and for you to receive your finder’s fee. The Wholesaler may earn as much as $1,000 or more and not require the investor to close the deal.

- Thoroughly vetting properties under contract: This approach offers the investor a fully vetted property under contract. This gives the investor the ability to close on the real estate opportunity quickly. This approach provides the highest profit potential and does not require the investor to close on a deal.

The table below lists examples of information and documentation required for these approaches: