Motivated Sellers

To find motivated sellers, you must first understand what causes their motivation and then consider what signs you may look for that indicate they are distressed and need your help. For example, someone who is facing foreclosure is motivated to find a solution. Signs can be found in the public records where the first foreclosure steps are filed by a lender taking legal action on the loan in default. Another example is an owner of a vacant property and in obvious need of maintenance and repair. Drive through a targeted neighborhood and observe properties with overgrown lawns, no curtains in the windows, mail piling up, along with other signs the property needs repairs. This will start a marketing list of potentially motivated sellers that others may not know about without driving by the property.

Consider what situations cause people to be motivated to sell and make a list of everything that comes to mind. (i.e., job loss, job relocation, need to downsize, unwanted inheritance, death of a spouse/partner, divorce, retiring landlord, an empty rental property, etc.) After creating your list of motivations, write down where you would look for signs of people going through those situations and who they might talk to about the issue. Gather the contact information available from the resource you have identified. The resource could be a list broker, public records like tax owners facing tax lien/deed auctions, probate records, and the like.

For potential lead sources, find the tax department information for your investment city and state. If you cannot find it on a website, call the city or county and ask how you can obtain a list of delinquent property tax accounts. An easy way to become familiar with your resources is to look up a property address or owner in that area. (Do a name search for “J Smith” in the tax records if you do not know any property owners.)

Example:

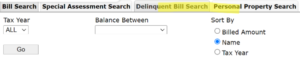

Mecklenburg County, North Carolina, has the following search on its public record search at taxbill.co.mecklenburg.nc.us/publicwebaccess…

When the tab for Delinquent Bill Search is selected, the search option changes…commercial listings.

The search results give a spreadsheet with the bill #, parcel #, owner name, property location, billed amount, and current tax amount due for everyone in the county meeting the search requirements entered. Not all 3,000+ counties and parishes across the country appear the same way. Still, suppose your investment area has this information readily available to you via the internet. In that case, you have the start of a potentially motivated seller list (at no cost). You can begin sending your marketing message.

Tenant-Buyers

To find tenant-buyers (people who want to buy but may need time to improve blemishes on their credit or save for a down payment and need to lease in the meantime), think about who they are in contact with or where you might reach them. They may have applied for a loan with a mortgage broker. Reach out to mortgage brokers and ask for referrals as part of your marketing plan. Post signs (bandit signs) or classified ads (Craigslist, social media) to let people know you can help them become homeowners with little or no credit – letting them know their job is their credit. Invite them to see what they may qualify for based on their income.

Investors

Depending on your investment strategies or techniques, you may want to have different types of investors on your buyer’s list. For example, suppose you are targeting pre-foreclosures. In that case, you will want a list of cash buyers ready to close on a purchase quickly if it meets their criteria. Foreclosure leads often have a time factor that requires a quick solution. An investor who has cash on hand to wholesale to or partner with you on creative negotiations with the lender can make all the difference in providing a much-needed solution.

You may be wholesaling distressed properties in a market with lots of owner-occupied homes. You will want to find investors looking for properties to fix and retail to homebuyers.

Investors looking for income properties will have different criteria, and you will market to them based on their investment interests. They are generally referred to as absentee owners. They may own multiple single-family homes, 2 to 4-unit buildings or 5+ unit buildings under a corporate structure.

Networking is a great way to identify investors and determine their standards for deals they want to invest in. Referrals from real estate professionals who work with them are also good sources since a personal recommendation is the least expensive and most effective advertising. However, list brokers who sell data are another source for identifying these types of leads.

Example:

Listsource.com is a data broker with ‘Quick Lists’ of partially defined data like Absentee Owners, Foreclosure Prospects, and numerous others. You can also build your list by narrowing down the location, property characteristics, demographics, foreclosure status, and more. Once you decide on the criteria, you can price out the list without an obligation to buy. (You will have to sign up for a free account to get the price quote for the list.)

Some subscription-based software options allow you to pull records with a cap on the number you can download monthly.

Either way, the cost per record can be as low as a few pennies each.

Renters

If you have or will have rental properties, you will need to market any available properties to rental candidates. Your marketing will likely be a matter of advertising the specific home, apartment, or commercial space. However, there are steps you can take to streamline that process and minimize the time the property you’ve been renting is vacant and not producing income. These steps need to be planned well before the property becomes vacant between renters. Suppose you already have the floor plan, the photos, and the right words designed to create interest before a property is even vacant. In that case, you can generate interest while you’re getting it ready for the next resident. Suppose it is a property that is new to your portfolio. In that case, you can still use a well-crafted description to generate interest with a ‘coming soon’ caption.

Where you advertise will depend on if it is subsidized/affordable-rate or market-rate housing. With affordable rate housing, you may be able to connect with agencies and websites that assist with subsidized housing in some markets. Placing ads or flyers in mom-and-pop grocers or convenience stores around the property location and signage on-site are also effective advertising methods in many markets. Social media, real estate websites, and on-site signage often work well with market-rate housing. Commercial spaces could benefit from using a real estate agent/broker and websites specializing in commercial listings.